Investing can be an intimidating and hard undertaking. But due to its ease of use and potential for profit, the mutual fund is one financial product that has grown in popularity. We will examine mutual funds in this tutorial, including their varieties, advantages, hazards, fees, and how to select the best one for your investing objectives.

Structure of a Mutual Fund

A. Fund Manager

Professionals that oversee mutual funds are referred to as fund managers. These people are essential to the fund’s performance since they make investment choices after doing extensive research and analyzing the market. Their credentials and experience are essential for negotiating the intricacies of the financial markets.Professionals that oversee mutual funds are referred to as fund managers. These people are essential to the fund’s performance since they make investment choices after doing extensive research and analyzing the market. Their credentials and experience are essential for negotiating the intricacies of the financial markets.

1. Role and Responsibilities

The fund manager is in charge of managing the portfolio of the fund, deciding what to buy and sell, and making sure the fund meets its goals as specified. This entails keeping a close eye on specific securities, market trends, and economic situations.The fund manager is in charge of managing the portfolio of the fund, deciding what to buy and sell, and making sure the fund meets its goals as specified. This entails keeping a close eye on specific securities, market trends, and economic situations.

2. Expertise and Qualifications

Investors frequently seek out fund managers having a track record of success, an appropriate degree, and financial industry experience. Success requires the capacity to adjust to shifting market conditions and make appropriate investment decisions.Investors frequently seek out fund managers having a track record of success, an appropriate degree, and financial industry experience. Success requires the capacity to adjust to shifting market conditions and make appropriate investment decisions.

B. Investors

Mutual funds pool money from a diverse group of investors, including both individuals and institutions

1. Individual Investors

Individuals who may not have the time, knowledge, or capital to invest directly in the stock market find mutual funds an attractive option. By contributing to a mutual fund, they gain exposure to a diversified portfolio managed by professionals.

2. Institutional Investors

In addition to individual investors, institutions such as pension funds, insurance companies, and endowments also invest in mutual funds. The large sums of money these entities bring further contribute to the fund’s overall capital

How Mutual Funds Work

A. Pooling of Funds

The pooling of money from several investors is one of the core ideas of mutual funds. After then, a diverse portfolio of stocks, bonds, and other securities is assembled using this money pool.The pooling of money from several investors is one of the core ideas of mutual funds. After then, a diverse portfolio of stocks, bonds, and other securities is assembled using this money pool.

1. Contribution from Multiple Investors

Investors buy shares in the mutual fund, and their money is combined with that of other investors. This pooling allows for a more significant investment capital than an individual investor might have on their own.

2. Creation of Fund Portfolio

The fund management distributes the investment across multiple asset classes and industries by using the pooled funds to buy a diverse mix of assets. This diversification increases the potential for returns while reducing risk.The fund management distributes the investment across multiple asset classes and industries by using the pooled funds to buy a diverse mix of assets. This diversification increases the potential for returns while reducing risk.

B. Investment Strategies

1. Diversification

One important tactic used by mutual funds to distribute risk is diversification. The fund seeks to lessen the negative effects of a single investment’s poor performance on the portfolio as a whole by spreading its investments over a range of assets.

2. Asset Allocation

Asset allocation decisions are made by fund managers taking into account the goals of the fund and the state of the market. The process of making decisions entails assessing the possible risk and return of various asset classes.

C. Net Asset Value (NAV)

1. Calculation

A key indicator for mutual funds is net asset value (NAV), which is the market value of the fund’s assets per share. It is computed by deducting liabilities from assets and dividing the remaining amount by the total number of shares that are outstanding.

2. Importance

Investors keep an eye on NAV in order to evaluate the fund’s performance and calculate the return on their investment. Variations in NAV might reveal information about the state of the market and the overall health of the fund.

Types of Mutual Funds

A. Equity Funds

Stocks are the main asset class of equity funds, which has a higher risk but also the possibility of large rewards for investors.

1. Focus on Stocks

A large amount of the assets held by equity funds are invested in stocks, giving investors ownership stakes in a range of businesses. There is a chance for dividends and capital growth with this ownership.

2. Risk and Return

When comparing equities funds to other mutual fund categories, their risk-return profile is higher. Stock market changes can cause considerable swings in the value of the fund’s shares.

B. Bond Funds

Bond funds concentrate on fixed-income assets, providing a moderately risked but more consistent income source for investors.

1. Emphasis on Fixed-Income Securities

Bond funds purchase a range of bonds from corporations, governments, and municipalities. The interest paid on these bonds gives investors a consistent stream of income.

2. Income and Stability

Bond fund investors aim to strike a balance between capital preservation and income generation. Bond funds carry some risk, even though they are often less volatile than equity funds, especially in circumstances where interest rates are fluctuating.

C. Money Market Funds

Money market funds invest in short-term debt instruments and are considered low-risk, low-return investments.

1. Short-Term Debt Instruments

Generally, short-term securities like Treasury bills, certificates of deposit, and commercial paper are the investments made by money market funds. Compared to other fund kinds, these investments give lower returns but are safer and more liquid.

2. Low Risk, Low Return

For investors looking for liquidity and capital preservation, money market funds are a good option. But since the returns are typically low, people looking for bigger yields find them less alluring.

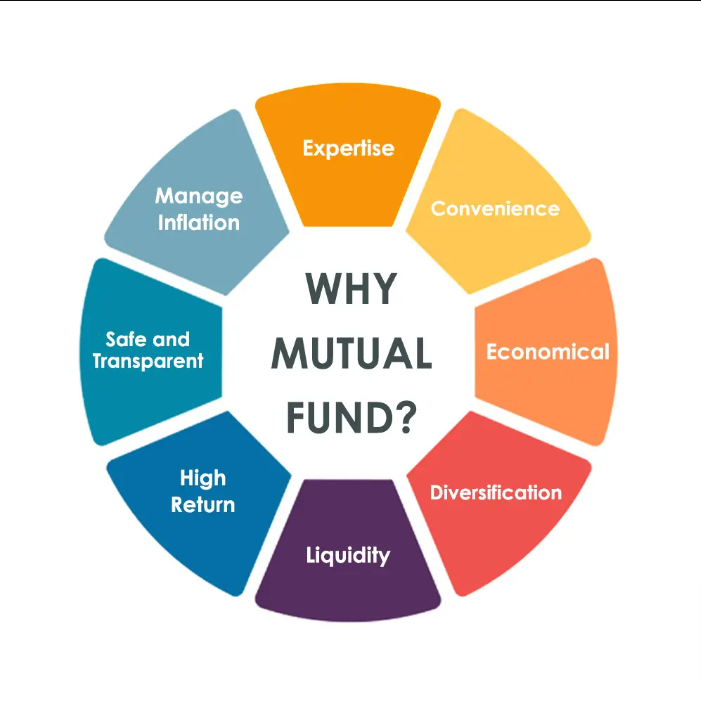

Advantages of Mutual Funds

A. Professional Management

Having access to qualified fund managers who make investment choices on behalf of clients is one of the main advantages of mutual funds. This knowledge is especially helpful to people who do not have the time or experience to actively manage their finances.

B. Diversification

One of the main components of investment risk control is diversification. Mutual funds distribute risk across a range of asset classes, sectors, and geographical areas by holding a variety of securities.

C. Liquidity

Investors in mutual funds have access to liquidity, which enables them to buy or sell shares on any business day. Investors can easily access their money when needed thanks to this liquidity, which offers a degree of flexibility that may be lacking in individual investments.

D. Accessibility

A broad spectrum of investors with different financial capacities can access mutual funds. Because many funds have comparatively modest minimum investment requirements, those with minimal cash may find them to be an appealing option.

Risks Associated with Mutual Funds

A. Market Risk

Mutual funds are not exempt from the market risk that affects all investments. Market swings may have an impact on the portfolio value of the fund, resulting in profits or losses for investors.

B. Credit Risk

Particularly bond funds are subject to credit risk, which is the possibility that the bond issuers the fund owns will not make their payments as agreed. This may have an effect on how well the fund performs and how much money investors make.

C. Interest Rate Risk

The value of bond funds may change in response to changes in interest rates. Investors in bond funds may experience losses if interest rates rise because of the potential decline in the value of current bonds.

D. Liquidity Risk

Even while mutual funds are often liquid, there may be issues with liquidity depending on the state of the market or particular investments made inside a fund. Selling particular securities during periods of market stress may be more challenging, which could affect the fund’s capacity to fulfill redemption requests.

Fees and Expenses

A. Management Fees

Mutual funds charge fees to cover the costs of managing the fund. Management fees are typically calculated as a percentage of the fund’s assets under management (AUM). Investors should be aware of these fees, as they

Q: What is a mutual fund and how does it work?

A mutual fund is a pooled investment vehicle managed by professionals. Investors buy shares, and the fund manager uses the pooled money to create a diversified portfolio of stocks, bonds, or other securities, aiming to achieve the fund’s objectives.

Q: What are the advantages of investing in mutual funds?

Mutual funds offer professional management, diversification, liquidity, and accessibility. Fund managers make strategic decisions, diversification spreads risk, liquidity allows easy access to funds, and they are accessible to a wide range of investors.

Q: What are the risks associated with mutual funds?

Mutual funds are exposed to market risk, credit risk, interest rate risk, and liquidity risk. Market fluctuations, defaults by bond issuers, changes in interest rates, and difficulties in selling certain securities during market stress can impact the fund’s performance.

How do I choose the right mutual fund for my investment goals?

Consider your investment goals, risk tolerance, the fund’s performance history, and fees. Assess whether the fund aligns with your objectives, understand the level of risk you are comfortable with, and carefully evaluate the fund’s past performance and associated fees.